To pay off debt faster, start by tackling the smallest debt first, not the one with the highest interest rate (we call this the debt snowball method). Seriously, if you’re only paying your minimum payments, those balances will hang around forever. Throw more money at your debt than just the minimum payment. Use that extra cash to pay off more debt. But don’t just earn more money for the sake of improving your debt-to-income ratio. Anything you can do to earn more income will help lower your DTI. Work on getting rid of the payments you already have. Don’t be tempted to add any more payments to your plate. Taking on more debt will just make your DTI percentage rise (and also your stress level). Here are a few practical tips to lower your debt-to-income ratio:Ī perfect new couch that’s calling your name? That boat you’ve been eyeing for years? Nope. If you want to lower your DTI, you need to decrease your monthly debt or increase your monthly income. You actually have more control over that number than you might think. If looking at your debt-to-income ratio made your blood pressure rise a little, take a breath. And we don’t want that for you! Use our mortgage calculator to make sure you don’t get in over your head. Before you apply for a mortgage loan, a better question to ask is, “How much house can I afford?” When you’re buying a house, it’s easy to get excited and take on more than your budget can actually handle.

Generally, lenders prefer your back-end ratio to be below 36%, but some will allow up to 50% when applying for a mortgage.īut wait just a second. What is the debt-to-income ratio to qualify for a mortgage? Lenders typically use the back-end-ratio because it gives a more accurate picture of your average monthly payments.

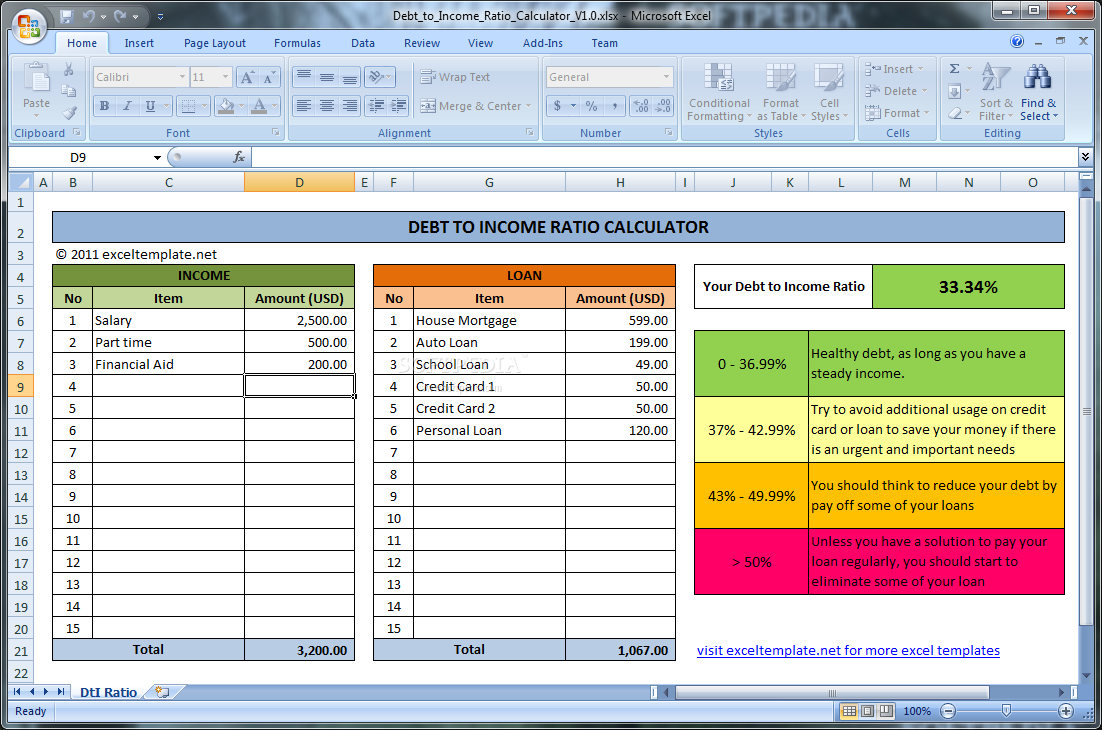

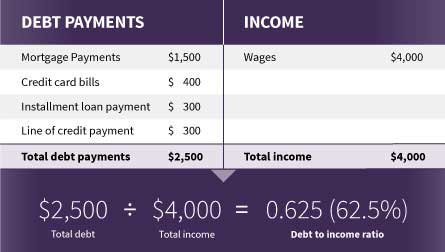

#Commercial mortgage calculator with debt to income ratio plus#

Lenders prefer your max front-end ratio to be 28% or lower, but if you’re following our plan, your total housing costs shouldn’t be more than 25% of your take-home pay.Ī back-end ratio includes your monthly housing costs plus any other monthly debt payments you have, like credit cards, student loans or medical bills. When applying for a mortgage, lenders will look at two different types of DTIs-a front-end ratio and a back-end ratio.Ī front-end ratio only includes your total monthly housing costs-like your rent, mortgage payment, monthly homeowners association fees, property taxes, and homeowner’s insurance. Add in normal living expenses, like groceries and insurance, and there’s not much left over for saving or covering an emergency-and another loan could tip you over the edge. With a DTI ratio over 50%, that means over half of your monthly income is going to pay debt. When your DTI gets to this level, you’re almost too risky for lenders, and you may not be able to get a loan.Īt this point, you’re in the danger zone, and lenders probably won’t lend you money. You won’t necessarily get turned down for another loan, but lenders will proceed with caution. In this range, lenders get nervous that adding another loan payment to your plate might be challenging, especially if an emergency pops up. Lenders view a DTI under 36% as good, meaning they think you can manage your current debt payments and handle taking on an additional loan. The criteria can vary from lender to lender, but here’s a general breakdown of the industry standards: It is often considered equal to earnings before interest and tax (EBIT).Now that you know how a debt-to-income ratio is calculated, you might be wondering what lenders think of your score. Net operating income is a company's revenue minus certain operating expenses (COE), not including taxes and interest payments. The formula for the debt-service coverage ratio requires net operating income and the total debt servicing for a company.

0 kommentar(er)

0 kommentar(er)